will i get a tax refund if i receive unemployment

Received 2020 state tax refund by direct deposit but didnt get GSS. Taxpayers should not have been taxed on up to 10200 of the unemployment compensation.

Unemployment Are Benefits Taxed Income Fingerlakes1 Com

The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received.

. Again the answer here is yes getting unemployment will affect your tax return. The amount of the refund will vary per person depending on overall. Will I still get a tax return if I was on unemployment.

6 hours agoReceived Golden State Stimulus I or II by direct deposit. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year. People might get a refund if they filed their returns.

You wont be able. If your state conformed with the federal unemployment insurance compensation tax exclusion you may need to file an. Generally you have up to three years to file an amended return.

Tax refunds on unemployment benefits to start in May. The IRS will automatically recalculate the tax you owe and issue a refund if you overpaid your unemployment income tax. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

Because we made changes to your 2020 tax account to exclude up to 10200 of unemployment compensation you may be eligible for the Earned Income Credit. The IRS is still processing returns from the beginning of the year. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

However so far over 10 million people have been identified who will be eligible for unemployment tax refunds. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000. If I Paid Taxes On Unemployment Benefits Will I Get A Refund.

If you already filed your 2020 tax return and you did not get the unemployment exclusion on the tax return that you filed the IRS will recalculate your tax return and send you. If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check. Can you track your unemployment tax refund.

However there are a few cases where filing an. This is not the amount of the refund taxpayers will receive. If youve paid too much during the year youll.

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Are You Eligible For Unemployment Tax Refund Lendstart

2 8 Million People Are Getting Irs Refunds This Week 10 Million More May Get Money Too Wbff

Not Sure If I Am Owed The Unemployment Tax Refund R Irs

Dor Unemployment Compensation State Taxes

Taxpayers May Receive A Refund For Taxes Paid On 2020 Unemployment Compensation Tax Pro Center Intuit

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Irs Sends Out 4 6 Million Refunds To Taxpayers For Overpayments Wfmynews2 Com

Unemployed In 2020 Get Ready For A Big Tax Refund

Tax Refunds For Unemployed Americans Are Hitting Bank Accounts Cbs News

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

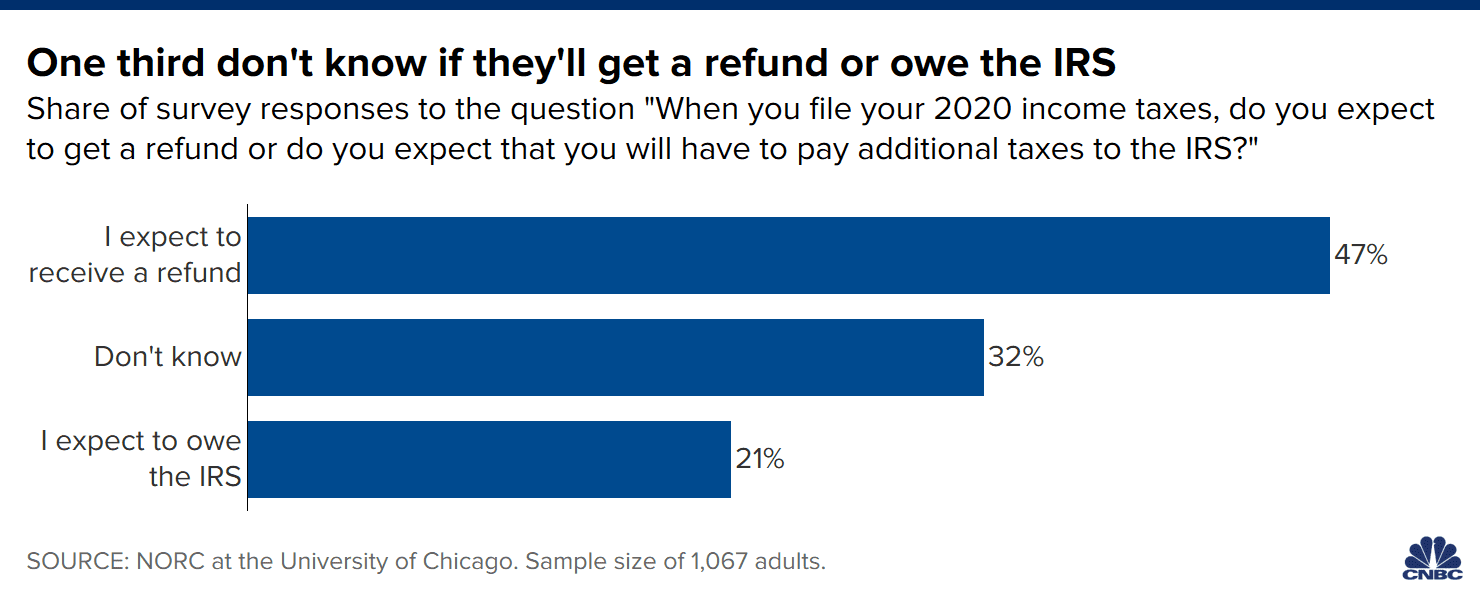

Will You Get A Tax Refund Or Owe The Irs 32 Of Americans Don T Know

Angry Taxpayers See Some Extra Tax Refunds Relating To Jobless Benefits

When Will Irs Send Unemployment Tax Refunds 11alive Com

Unemployment Benefits In Ohio How To Get The Tax Break

Your Unemployment Tax Refund Is Coming In May Irs Says Here S How To Get Yours Nj Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger